Entities that submit transactions prospectively to receiving parties for reimbursement

Numerous flexible methods are available to connect and access a robust 2-way communication network for simplified connectivity

Fax bills & attachments via your fax machine, and bills are converted to data, attachments are indexed to the bill data, then loaded back into iCompEDI® for processing. Users can upload additional attachments to the now electronic record or simply release for processing.

Upload PDF bills & attachments through our iCompEDI® web portal and bills are converted to data, then loaded back into iCompEDI® for processing. Users can upload additional attachments to the now electronic record or simply release for processing.

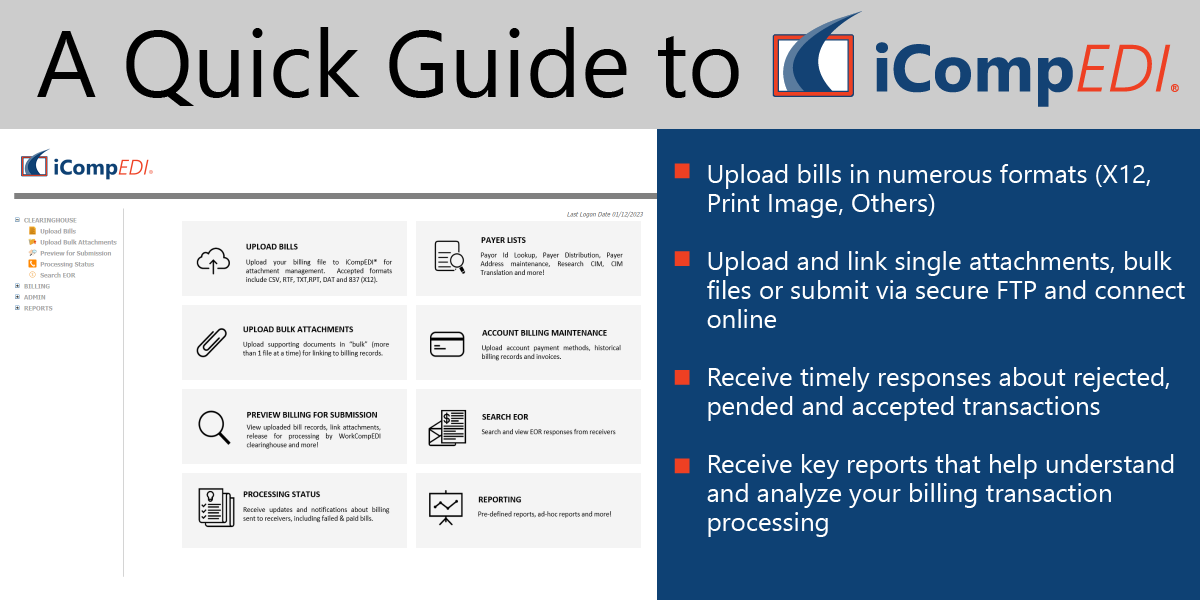

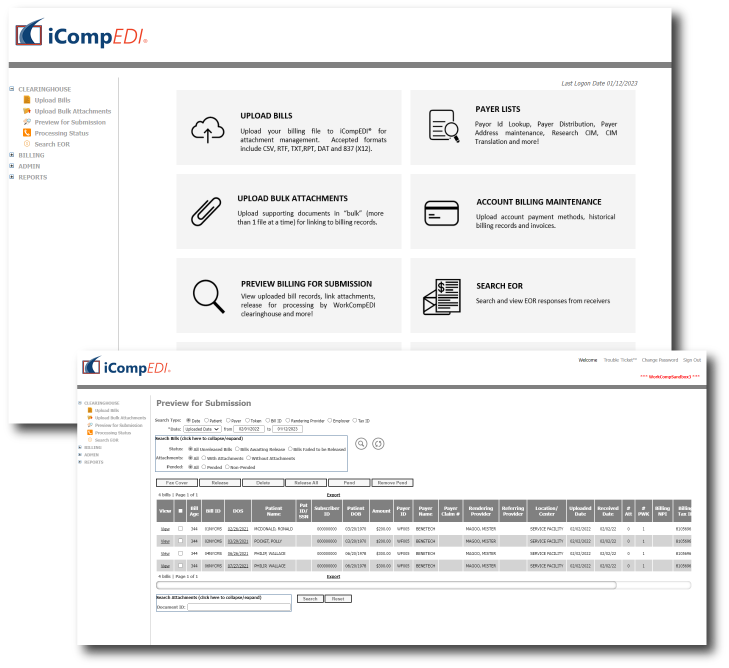

Using the iCompEDI® web portal billing system, users can upload X12 837 bills & link attachments for processing, receive back X12 responses (999, 277, 835) and more.

Power users can submit X12 837 or custom files and attachments via sFTP, and receive back X12 responses (999, 277, 835) and more.

Users can use their existing vendor partner or clearinghouse to submit transactions to Great American Insurance Group, and they will be routed to Data Dimensions seamlessly.

The Payor ID for Great American Insurance Group is WZ013

However, if you are seeking to submit EDI through someone other than Data Dimensions, please check with your trading partner to see if they have assigned a different (but still valid) Payor ID to this route.

YES – Great American Insurance Group and Data Dimensions have teamed up to maximize electronic submissions for Great American Insurance Group clients and have invested a great deal of resources to maximize the value of the partnership. Sending bills through Data Dimensions ensures your transactions are being received and processed in the most efficient and timely manner.

You should use the specific Payor ID issued to the Great American Insurance Group client in order to ensure your bills are adjudicated in a timely manner. Use the Payor ID Lookup tool on the Data Dimensions website to find the right Payor ID for your designated receiver.

NO – while submitting your billing through Data Dimensions is the fastest method to reach Great American Insurance Group (since all bills are delivered electronically within 24 hours of receipt), your company can send bills through your vendor-partners who may be connected with Data Dimensions. While this adds 24-48 hours to your bills reaching Great American Insurance Group (depending on your vendor-partner’s processing guidelines for delivery), your bills will reach Great American Insurance Group.

The most significant benefit is that Data Dimensions submits directly to Great American Insurance Group which means your transactions are delivered within 24 hours. Once you are set up with Data Dimensions to submit eBilling to Great American Insurance Group, you can also reach over 4,400 other electronic receivers. Plus, Data Dimensions is an all-Payor clearinghouse, which means if the receiver you are trying to reach does not accept electronic transactions, Data Dimensions will print & mail your bills and attachments using 1st class USPS at no additional cost! Not to mention, you will have a partner in the race to submit clean bills in a timely manner, along with enhanced tracking and validation of your submission.

There is a simple per-transaction charge of $0.65 per bill (with unlimited attachments for electronic routes) to use Data Dimensions as your submitting partner. Keep in mind, the industry average for electronic bill submission to work comp carriers can range from $0.85 to $1.00+ per bill, and most vendors will charge you extra for bills that need to be printed & mailed when an electronic connection does not exist. Added values include no setup or hidden fees, a month-to-month agreement, free access to our iCompEDI® billing management portal, no additional fees for support and valuable tracking reports that provide date & time stamps along with tracking numbers for each bill you submit (whether delivered EDI or paper).

YES – Data Dimensions can provide you with a powerful submission tool that uses bill data generated directly from your existing practice software tool. Your staff doesn’t need to re-type bill information into our systems or spend time stuffing envelopes. Simply use your existing practice software to create and submit electronic bills and images of supporting documents through our iCompEDI® billing management portal.

Data Dimensions accepts ANSI X12 837, print image, and custom formats for bill data, and PDF, GIF, JPEG, TIFF and other standard image formats for supporting documents.

YES – Data Dimensions maintains a large network of cooperative practice management software vendors focused on the auto casualty industry. Some of our key partners include TeamPraxis, Conexem, Prime Clinical, RevClaims and many more.

YES – Data Dimensions maintains one of the largest networks of cooperative clearinghouses in the auto casualty industry. Some of our key partners include Change Healthcare (RelayHealth), Cognizant (Trizetto), Availity (RealMed), Jopari, Optum (P2PLink), and more! Where your vendor is connected with Data Dimensions, you can submit bills to not only Great American Insurance Group, but also thousands of other receivers.

Since there are no up-front or monthly expenses, you have no risk in establishing an account with Data Dimensions to submit eBilling. However, if we fail to provide you with 100% customer satisfaction, and you wish to terminate your service agreement, we will easily cancel your service with our company.

Data Dimensions offers an array of ways to submit your bills to our firm for processing, including: 1.) output a flat file of bills and images from your software and send it to Data Dimensions directly (using a secure FTP tool); 2.) you can submit your bills using our iCompEDI® portal (using many formats, including ANSI X12 837, print image, or proprietary) and either upload your supporting images directly (as single images or a bulk of images), or you can fax your documents using the barcoded fax cover sheet generated for each bill; or 3) you can fax both bills and supporting materials to our firm and receive your reports back through your fax machine using our CompFax® service, where we convert the data off your faxed bill into EDI for submission electronically to receivers. In all cases, you can use any combination of the options above to meet your needs.

You can use iCompEDI® or submit a flat file of your bills, and then use our fax-to-EDI CompFax® service to submit your supporting documents for each of the bills. If that doesn’t work for your existing workflow, you can submit your bills via iCompEDI® and then send us a single file of images with an index file. Or, we can work with you to create a process that works for your office to ensure it does not disrupt your existing billing workflows. It comes down to what is easiest for you and your organization.

YES – Data Dimensions always provides back an “Immediate Verification” report outlining each bill transmitted and whether it was accepted or rejected by our clearinghouse front-end edits. Then, we will pass back any information provided by the receivers as they adjudicate the transactions, and in some cases even pass back electronic remittances (835) which we can return as an ANSI X12 835 file or as a human-readable report. Most importantly, you will have a record of your submission, including a tracking number for each bill, which provides immediate appeals validation when discussing timely filing concerns.

Click here to complete our sign-up form. We will review your information and be in touch shortly to go over the options that best suit your needs and get you started on the road to saving time and money.

Data Dimensions provides submitters (doctors, hospitals, clinics, billing companies and others who submit billing outwardly for reimbursement) a single-source, all-payor turnkey partner for eBilling services in the Property & Casualty (auto casualty, workers’ compensation, and personal injury markets) with access to over 4,400 electronic receivers (employers, bill review firms, insurance plans, networks and others who receive and process billing).

Where an electronic route is not available, Data Dimensions prints & mails the transactions (with supporting documents) at the same rate as an EDI transaction(no hidden or additional fees)using 1st class USPS mail from its own print facility (not outsourced)

Using a combination of Data Dimensions products and services, submitter clients can submit all bills and notes – to all payors – in a flexible method, without hidden fees.

Data Dimensions retains established integration or interfacing partnerships with the following market leading vendors. Each relationship brings a different level of white-label or custom integration capabilities to end-users, limiting learning curves and enhancing adoption.