Reduce Expenses, Increase Efficiencies With DD Check Processing Solution

For insurers, utilities, nonprofits, government agencies, and other billers seeking a solution to the costs...

Organizations involved in the billing process – including insurers, utilities, governments and nonprofits, among others – can benefit from Check 21, Data Dimensions’ processing solution that offers efficiency, security and other benefits for companies frustrated with the costs of complexities of handling paper checks.

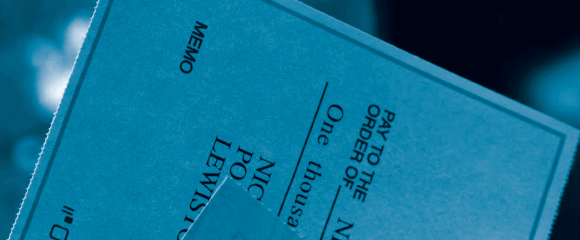

Check 21 requires a fraction of the time normally taken by manual check processing. Paper checks are scanned, all necessary fields (date, amount, MICR information, etc.) are automatically captured, then the images and data are sent to Data Dimensions’ highly secure image repository, where they are stored and made instantly available to authorized employees and customers of your organization for viewing. Information is then validated, and the electronic data file is transmitted for settlement or deposit processing.

Among the benefits of Data Dimensions’ Check 21 solution:

What’s more, Check21 complements Data Dimensions’ services for managing image capture and transmissions, security and support requirements. If your company is struggling with the processing of paper checks, Data Dimensions’ Check 21 is the solution you’ve been seeking.

Subscribe to get fresh news and resources delivered straight to your inbox.