Electronic CMS-1500 Submission Requirements for New York in 2025

Healthcare providers in New York are gearing up for a significant shift in medical billing...

With the landscape of the Workers’ Compensation industry continually shifting, the integration of modern technology is no longer a luxury—it’s a prerequisite for survival. Electronic billing (eBilling) has emerged as a key function in this industry, streamlining processes and fostering more effective communication between healthcare providers and payors. Explore the intricacies of mandated eBilling within the Workers’ Compensation realm, evaluating its current implementation and predicting its forward momentum.

The shift from paper to digital has been accelerating, and this is especially true for billing processes within the medical sphere. Across various states, legal and regulatory frameworks have been established to mandate the adoption of eBilling systems. These requirements aim to streamline administrative procedures, reduce errors, and ultimately lead to better patient experiences.

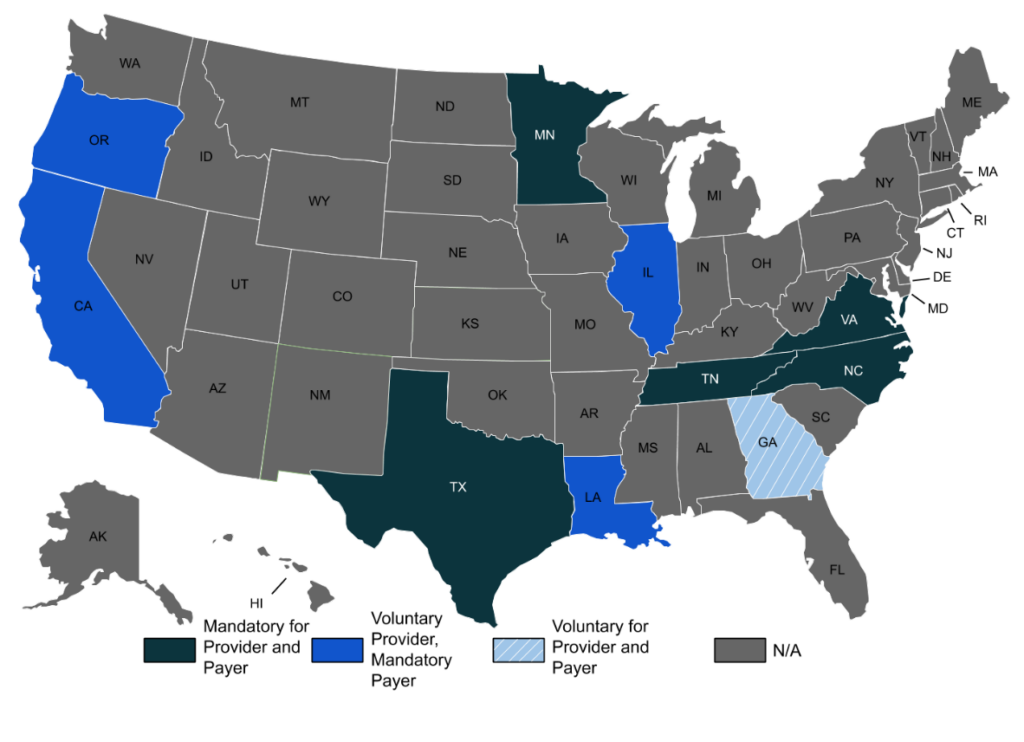

Many states have taken the initiative to require eBilling in some capacity specifically for workers’ compensation claims to modernize the healthcare system and improve efficiency. According to IAIABC, Minnesota, North Carolina, Tennessee, Texas, and Virginia all require both payors and providers to participate in electronic billing. California, Illinois, Louisiana, and Oregon have made it mandatory for payors to accept electronic billing for workers’ compensation to expedite claim settlements and reduce administrative burdens.  Beyond the prescribed efficiency benefits seen in states with eBilling requirements, the movement towards eBilling in workers’ compensation scenarios recognizes the urgency of rapid and transparent claim processing. In most states, the expectation is not only the submission of bills electronically but also the need for timely responses from payors. This includes the acknowledgment of receipts and prompt adjudication of bills within specific time frames as mandated by state regulations.

Beyond the prescribed efficiency benefits seen in states with eBilling requirements, the movement towards eBilling in workers’ compensation scenarios recognizes the urgency of rapid and transparent claim processing. In most states, the expectation is not only the submission of bills electronically but also the need for timely responses from payors. This includes the acknowledgment of receipts and prompt adjudication of bills within specific time frames as mandated by state regulations.

States are increasingly emphasizing the standardization of eBilling formats. They often adopt national standards such as the ASC X12N 837P and 837I Health Care Claim standards for the electronic submission of professional and institutional provider bills. This uniformity is crucial in reducing confusion and ensuring a cohesive framework where all parties understand the expectations and can integrate systems more seamlessly.

It is also worth noting that enforced compliance includes not only the method of submission but also strict maintenance of records and data security protocols to protect sensitive patient information. The Health Insurance Portability and Accountability Act (HIPAA) plays an integral role in dictating these standards, further intertwining eBilling protocols with overarching federal regulations governing patient data and privacy.

Trends and Innovations

It’s evident that technology is driving significant changes for medical providers and payors. Artificial intelligence (AI) and machine learning algorithms are now being employed to automate the coding and billing process, thereby reducing human error and increasing the speed of claims processing. These intelligent systems are adept at flagging discrepancies and ensuring that claims conform to complex billing codes and regulations. Additionally, an increasing number of platforms are enabling real-time eligibility checks and claim status updates, which significantly enhances transparency and efficiency. Real-time data exchange between providers and payors can eliminate the ambiguity of claim statuses and enable quicker resolution of issues.

Additional Read:

As Billing Grows More Complicated, It’s Time to Automate Your Process

In response to the ever-evolving digital landscape, regulatory bodies are beginning to explore standardized Application Programming Interfaces (APIs) that would allow disparate eBilling systems to communicate with one another seamlessly. The adoption of such standards ensures that even as individual systems evolve separately, they can still operate within a common framework that promotes interoperability.

For example, a company that is directly integrated with Electronic Health Records (EHRs) and Practice Management systems can bring providers closer to payors than ever before. Seamless integration means that billing data flows directly from the healthcare provider’s activities into the billing system without the need for manual entry. This direct connection facilitates real-time claim updates, automated record attachments, faster issue resolution, and immediate eligibility checks, considerably reducing the turnaround time of payments. Such integrations embody the cutting-edge of eBilling systems, heralding a future where complexity is dramatically reduced, efficiency is enhanced, and the financial health of medical practices is strengthened.

Future Requirements and Expectations

As federal regulations adapt to the evolving digital landscape, several key pieces of legislation and regulatory initiatives could significantly influence the requirements for eBilling in the workers’ compensation sector in the United States.

Moving forward, these regulations, in conjunction with the pressure for increased efficiency and transparency in healthcare transactions, suggest that federal standards will evolve, potentially becoming stricter or more inclusive of the variety of billing transactions. Providers dealing with workers’ compensation claims must stay abreast of these regulatory changes to maintain compliance and optimize their billing. Partnering with an eBilling service vendor that is agile and scalable can keep you compliant while freeing up your time to focus on patient care while they keep up with the regulations facing the industry.

Additional Read:

Work Comp & Auto-Medical Claims Processing With Automated Attachments

Conclusion In conclusion, the integration of technology into the eBilling sector presents a formidable opportunity for medical providers and payors to streamline their operations, improve efficiency, and stay compliant with regulatory mandates. As we look to the future, adapting to and embracing advancements such as AI, real-time data interchange, and seamless system integration are keys to remaining viable in an increasingly digital healthcare landscape. While regulatory changes may appear daunting, they are also gateways to enhanced data protection, operational transparency, and ultimately, better patient outcomes.

Medical providers and payors must be proactive in staying informed and agile in their adoption of new eBilling technologies and standards. By doing so, they can ensure not only regulatory compliance but also the continued financial health and operational excellence of their practices in the face of a rapidly evolving digital healthcare system.

Subscribe to get fresh news and resources delivered straight to your inbox.